FHA home loans are mortgages which are insured by the Federal Housing Administration (FHA), allowing borrowers to get low mortgage rates with a minimal down payment.

VA loans are mortgages guaranteed by the Department of Veteran Affairs. These loans offer military veterans exceptional benefits, including low interest rates and no ...

Farm loans are financial products designed to provide funding to farmers and agricultural businesses for various purposes related to their operations.

USDA Rural Development Loans are insured by the U.S. Department of Agriculture to provide mortgages to the rural housing market by providing an affordable financing incentive.

Conventional loans are classified as such because they're not insured by the federal government. There are two types of conventional loans: conforming and non-conforming.

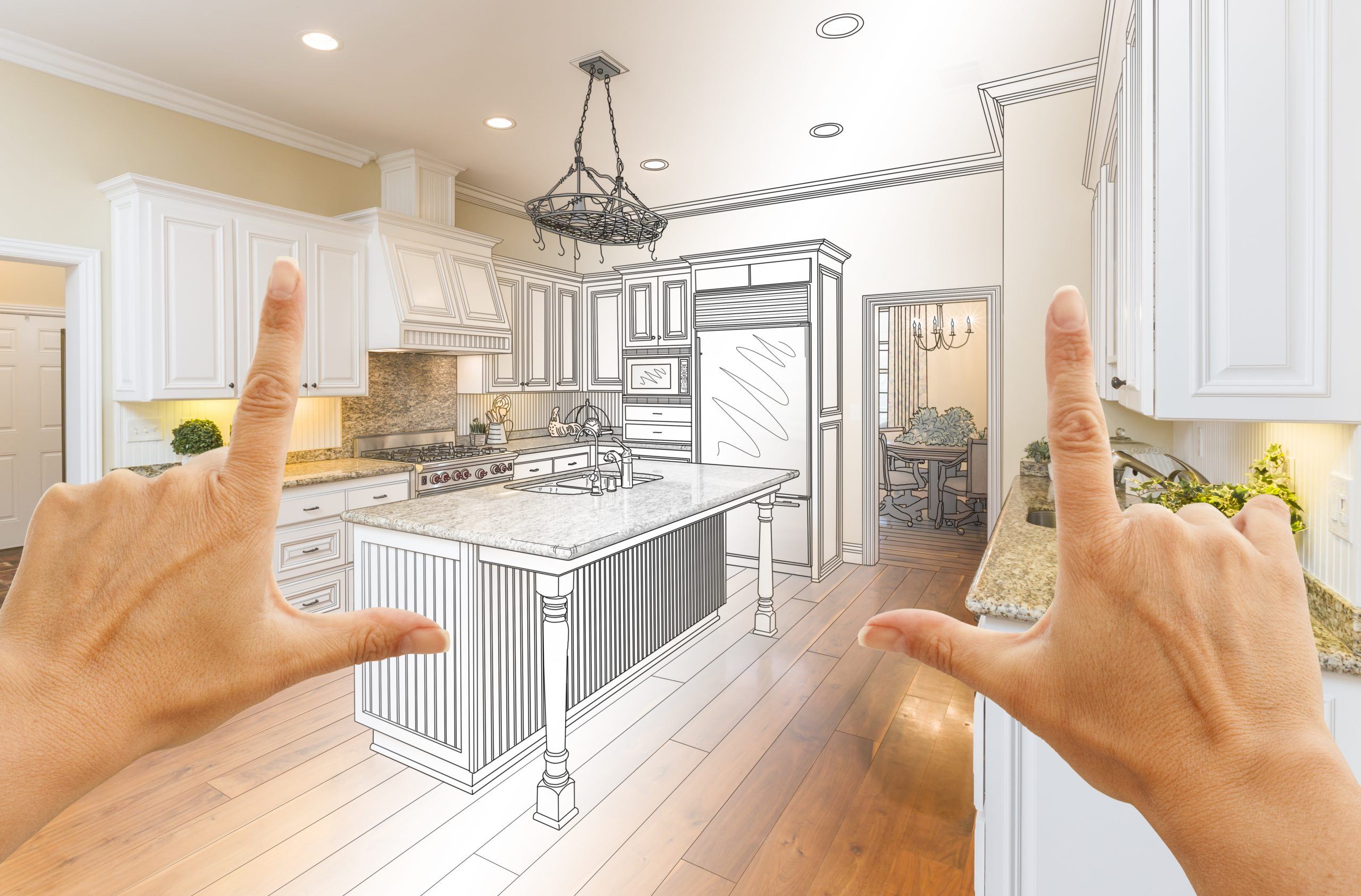

There are two types of renovation loans to include the FHA 203K Loan and the Fannie Mae HomeStyle Loan which allow borrowers to finance the renovation funds based on the "After Renovated Value".

With a reverse mortgage, instead of the homeowner making payments to the lender, the lender makes payments to the homeowner. The homeowner gets to choose how to receive these payments and only pays interest on the proceeds received.

Investor loans, also known as investment property loans or rental property loans, are financial products designed for individuals or entities looking to purchase real estate for investment purposes rather than as a primary residence.

A home equity loan allows homeowners to borrow a lump sum of money using their home equity as collateral. Home equity is the difference between the current market value of the home and the outstanding balance on the mortgage.

There are a number of different types of home loans available to you, and it can pay to familiarize yourself with them. Luckily we're here to help you choose the best type of home loan for your needs.

Get Started